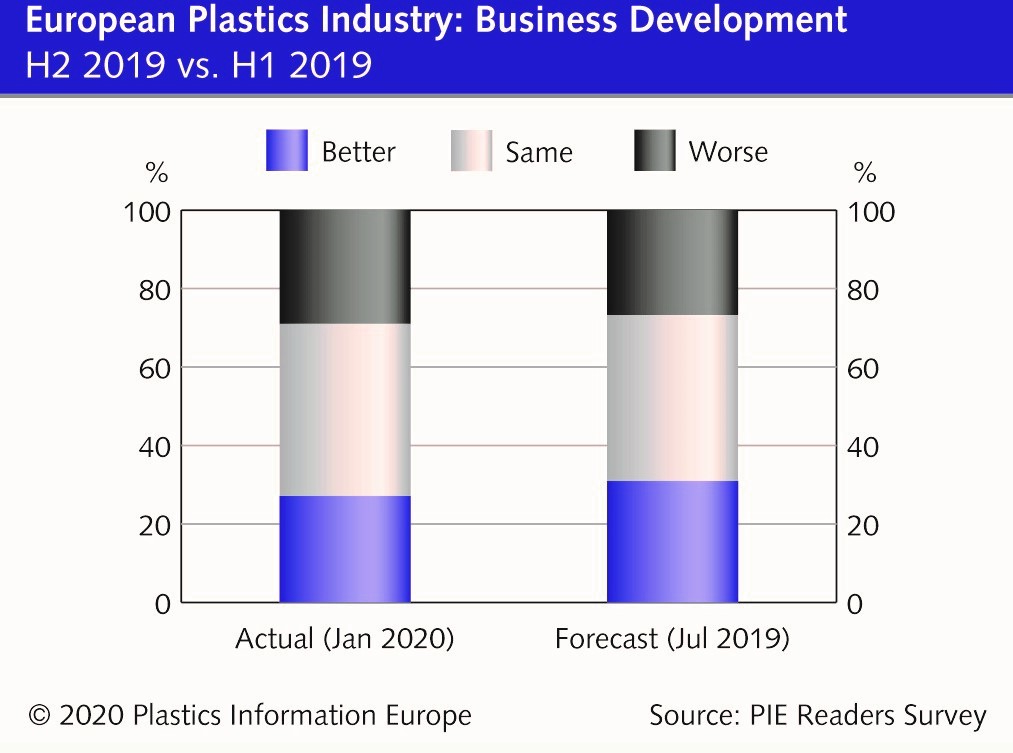

The regions with the largest share rating business in the 2nd half of 2019 as worse in a half-year comparison were Italy and German-speaking Europe. Across sectors, plastics converters fared well compared to many others, with around 39% rating business in the 2nd half of 2019 as better than in the 1st half.

The top concern for business performance in 2019 across all respondents in Europe was sales volumes, followed by selling prices and material costs. An exception was the Benelux region, where staff recruitment was rated as the number one concern last year. Plastics-related regulations are becoming a greater concern for 2020, especially in Benelux, France and Italy. Furthermore, the public backlash against plastics is worrying many European companies about business performance in 2020. More than 56% of them did not see an effect on business from the backlash in 2019, while one third witnessed a negative impact. Almost half of companies foresee a negative effect on business in 2020 because of the backlash, helped by the negative media coverage of plastics, for example, and this applies across the board for sectors, regions and company size.

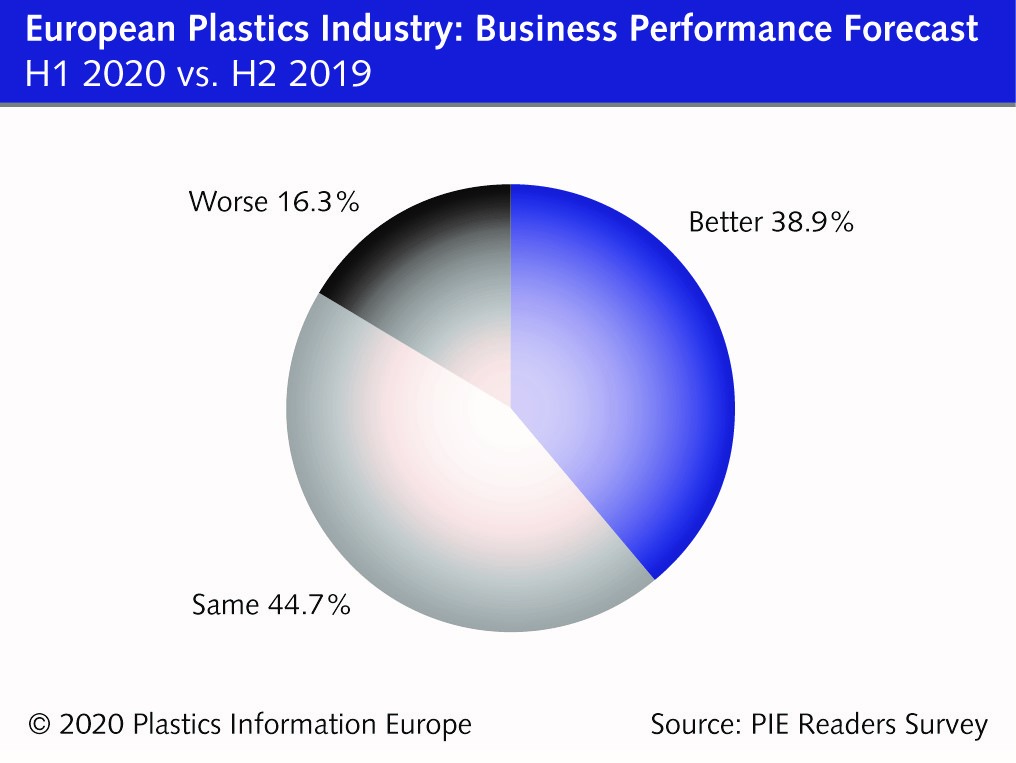

Looking ahead, 45% of respondents expect business in the 1st half of 2020 to stay the same as in the 2nd half of 2019, with 39% predicting better business. Related to some optimism for upcoming business performance, 33% said their company’s capital investment plans for tangible assets (property, plant and equipment) are increasing in the first six months of this year, while more than 50% said investment plans will stay the same.

Figure 1: Business development in the 2nd half of 2019 compared to the 1st half of 2019

Figure 2: Business performance forecast in the 1st half of 2020 compared to the 2nd half of 2019