Plastics Information Europe (PIE) reports that production bottlenecks for plastics and their intermediate products have in some cases cut the quantity available by up to half of the amount normally on the market. In Europe, polymer producers are currently dealing with 13 forces majeures, 11 system malfunctions, 22 slowdowns and 24 maintenance shutdowns.

At the same time, plastics goods producers face significantly lower imports from Asia, the Middle East and the US. Resin prices in the Far East have outpaced those in Europe for months, which has redirected much of the global flow of raw plastics from Europe to Asia.

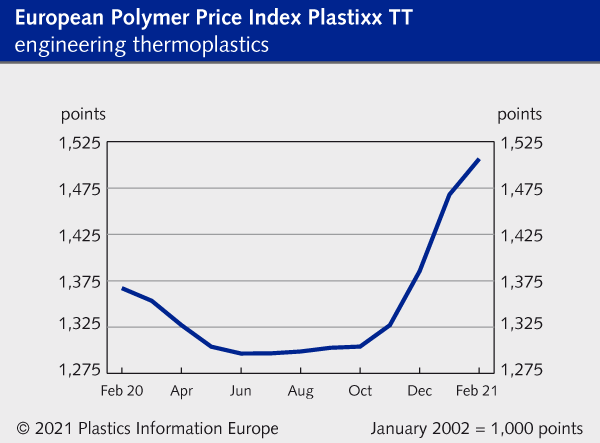

The combination of reduced supply and increasing demand is boosting prices for plastic granulate at an unprecedented rate. Depending on type, materials currently cost 20%-50% more than at the beginning of 2021. This shift poses major economic difficulties for plastics processors, who often have long-term contracts with their customers. Clauses for cost increases can only cushion the problems to a limited extent, due to the speed of price hikes.

Supply bottlenecks for materials are also endangering the production of end-products made of plastics. Isolated reports from the plastic packaging sector talk about limited delivery capabilities.

In early March, a webinar held by PIE’s sister publication Kunststoff Information (KI, Bad Homburg / Germany; www.kiweb.de) about the price and quantity situation provided insight into the current circumstances. More than 700 participants from across the plastics industry signed on to hear from experts and take part in a Q&A session. Of the more than 400 plastics processors on hand for the discussions, 77% admitted that they were affected by turbulence on the plastics markets, and 44% said the impact has been either severe or very severe. Almost half of the end producers said they were facing production downtimes due to the shortage of materials. Little chance for improvement seems forthcoming: some 70% of plastics processors said the market situation will not normalise before the third quarter. Webinar participants from the plastics and chemical production industries were even more pessimistic: 64% said market normalisation was due in the third quarter, with 29% saying it will take until the final three months of 2021.

There is, however, one consolation for plastics processors: Competing materials such as steel and paper are also currently struggling with difficult market developments. And in many application areas, as the pandemic has shown, plastics are simply irreplaceable.