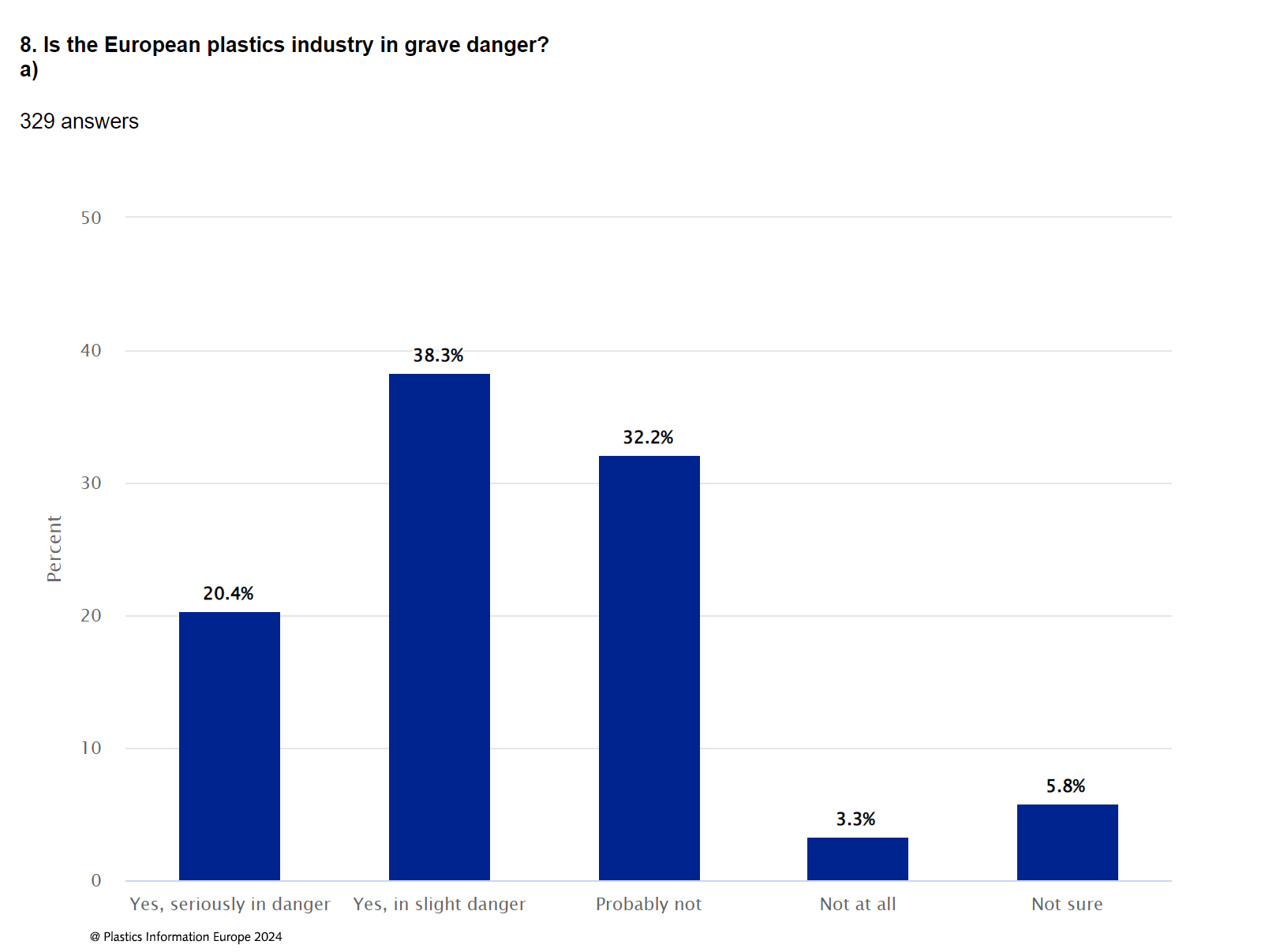

The question is, can the European plastics industry hope for things to gradually start getting back to normal? To find the answer, Plastics Information Europe conducted its 11th market survey, in which over 330 respondents from across Europe took part.

Business performance rolling downhill

Performance generally trended lower in H2 2023 – more than half the respondents admitted that the results of their commercial activity were worse in H2 2023 compared to H1; a roughly equal share found it either better or unchanged.

The regional split shows that business was primarily depressed in Benelux, where 100% of the respondents said their operations had deteriorated. The picture also seems grim in Central, Eastern, Southeastern, and German-speaking Europe, Italy, and the UK and Ireland. Among the industry sectors, business was particularly challenging for plastics recyclers and only slightly better for the responding companies engaged in polymer and chemical production.

European plastics at a crossroads: Will 2024 bring the elusive turnaround?

Although another half-year shattered the European plastics industry’s hopes for recovery, the general mood is far from its lowest ebb. Over a third of the respondents believe H1 2024 will bring their business much-anticipated improvements, which would be tangibly higher than in H2 2023. Only 16.7% of those surveyed expect new lows.

The closer to home ground, the more confident the respondents feel. On the domestic market, upturn is a likely scenario for 30.4% of those surveyed. When it comes to exports to other European countries, this figure is slightly lower, at 29.2%; only 26.5% of companies believe in the positive dynamics of their exports to non-European countries. Optimism persists in German-speaking Europe and Italy, where half of the respondents look forward to positive developments in the first quarter of the new year.

Promising investment plans focused on cost-cutting

Since change is the only constant, a shift in investment activity could bode well for the European plastics industry. The share of companies willing to invest seems to be looking up, reaching almost a third, against only 19.7% in H2 2023. This appetite for spending is the strongest since H1 2021.

The dynamics are also encouraging on the other end of the gauge, with only 23.9% of companies admitting plans to downsize investment programmes. While lower than in H2 2023, this is a far cry from the dismal 8% in H1 2021. The share of companies willing to spend more money in H1 2024 is the highest in Spain and Portugal, the UK and Ireland, and Central and Eastern Europe.

Considering the soaring costs along the value chain, it is not surprising that most respondents said their investment plans are primarily focused on cost-cutting solutions, as reported by almost 57% of the participants. Slightly over a quarter of those surveyed expressed readiness to jump into capacity expansion projects – a good result, given that business performance in the past couple of years left a lot to be desired.

Layoffs continue, hiring stagnant

The prevalent hiring trend continues – more companies are still letting go of employees than those hiring them. Nearly 30.3% of the respondents admitted to layoffs in H2 2023, against 26.2% in H1 2023. Only 18.2% reported growth in staff, compared with 19.3% in H1 2023. Slightly more than half of the respondents reported no change in employee strength.

There seems to be light at the end of the tunnel: More companies along the plastics value chain plan hiring than the ones eyeing layoffs in H1 2024. Employee retention remains the dominant trend, with 65.6% of the respondents expecting no major changes in workforce. Only 21.3% plan to increase hiring and 13.1% is looking to downsize.

Special concerns

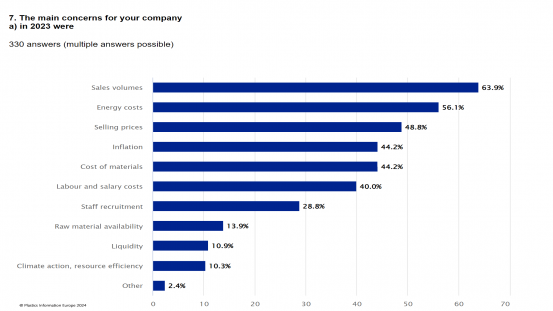

Sales volumes were chosen as the key concern by 63.9% of the respondents, reflecting fears that with not enough demand, businesses might be forced to downsize operations. Selling prices – a factor tightly linked to the general market health – were a concern for 48.8% of the surveyed companies.

Energy costs continue to bother at least 56.1% of the market players, while the cost of materials worries 44.2%; at least 40% of the companies are still marred by labour and salary costs. Though not as high as at the beginning of 2023, inflation is still cause for concern for 44.2% of the respondents. Overall, businesses managed to make ends meet, as the state of liquidity concerns only 10.9% of the surveyed companies.

AI not (yet) a big threat

Artificial intelligence has been around for a while, but it was in 2023 that it went mainstream and started causing chaos on the markets due to the fear of job losses. Apps like ChatGPT sparked discussions about the tectonic shifts such technologies could cause in virtually all segments.

But the European plastics industry is yet to feel the impact of AI and automation. Only 9.8% of the respondents believe their operations are already affected. A slight impact is recognised by 20.2%, while almost half asserted that AI is yet to unravel its potential. Among the areas where managers expect the most help from digital assistants are cost reduction, increased production efficiency, and better management performance.